Economic performance

Percentage of knowledge economy businesses

17.26%

(2025)

Previously reported at 17.71%

(2024)

Target of 22.99%

This update covers quarter 2 (July to September) for 2025 to 2026.

The second quarter for the second year of the economic strategy has seen the continued development of the Bracknell Forest Economic Partnership and progress towards the actions identified in the partnership’s action plan. The partnership has focussed on 3 priority areas that align with the economic strategy. Three groups have been created to support the priorities.

A list of co-working and shared office spaces has been compiled and published on the Bracknell Forest Economic Partnership website. A small working group has been established to explore and strengthen collaboration between local universities, businesses and Bracknell Forest Council. Initial meetings have taken place with Royal Holloway, University of London (RHUL).

In collaboration with a procurement lead from a major local business, plans are underway to organise an event aimed at helping SMEs access procurement opportunities with large corporate firms and public sector organisations in Bracknell Forest.

Working with the Digital Services team, we are exploring options for developing promotional materials that showcase Bracknell Forest as a prime business location.

Berkshire Growth Hub continue to offer comprehensive business support to start ups and existing businesses in the borough. We are working with the Growth Hub to deliver a pilot scheme exploring additional business support opportunities , both locally and nationally.

Membership in the Healthy Workplace Alliance continues to grow. The website provides an extensive range of resources to support businesses, with new content added regularly.

At the close of the first year, 2 businesses achieved awards under the scheme, while 2 others are actively working toward accreditation.

The September meeting was hosted by Waitrose, who have expressed interest in earning the award. During this meeting, Bracknell Forest Council was formally presented with its award.

Under each of the 4 themes in the Economic Strategy, there is one key metric that shows the current position of Bracknell Forest. These will be kept under review by the council’s economic development team and the Bracknell Forest Economic Partnership. Principal indicators are set out below.

Percentage of knowledge economy businesses

17.26%

(2025)

Previously reported at 17.71%

(2024)

Target of 22.99%

Companies in Bracknell Forest

With a turnover of £1 million to £5 million

8.08%

(September 2025)

Previously reported at 7.91% (September 2024)

Percentage of residents in lowest 3 occupational groups

17.5%

(July 24 - June 25)

Previously reported at 17.9%

(April 24 - March 25)

Full fibre connectivity

96%

(September 2025)

Previously reported at 95.8% (June 2025)

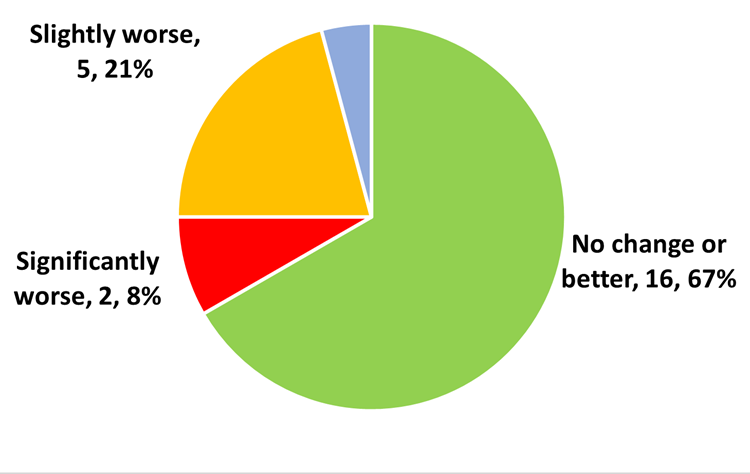

The quarter 2 report is an update on the base position set in reports for the first year (2024 to 2025) and quarter 1 (2025 to 2026). For quarter 2, the indicators and performance measures continue to show a broadly positive outlook.

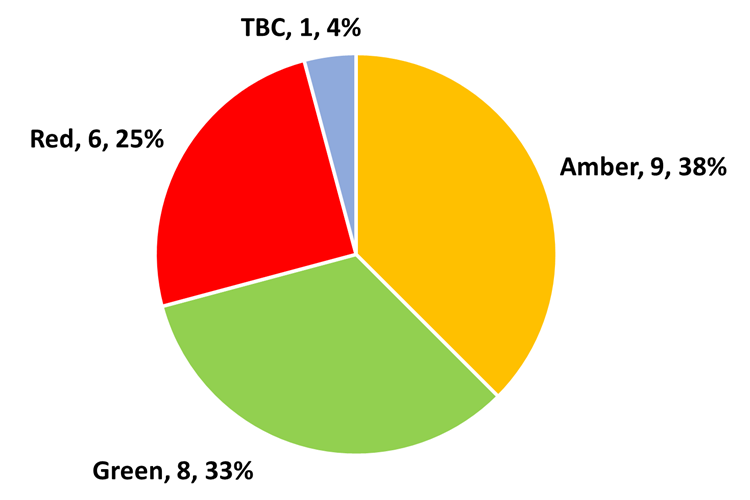

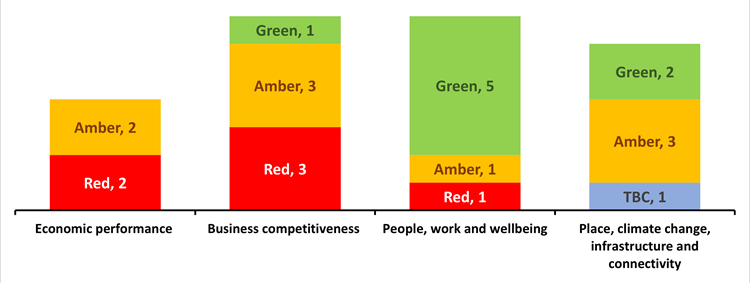

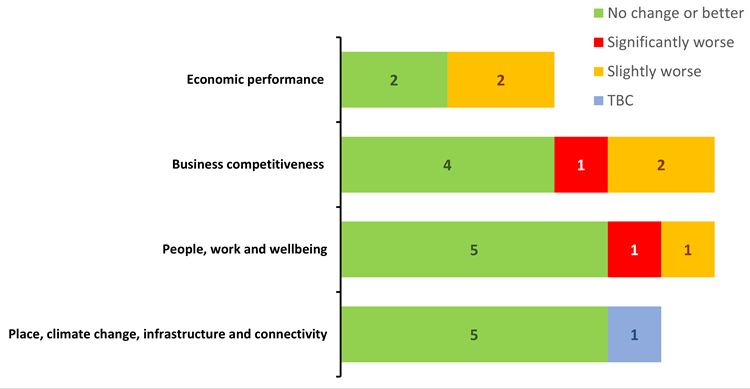

The following charts show the current status of the 24 key metrics under the priority themes identified in the Bracknell Forest Economic Strategy 2024 to 2034.

They provide an overview of the current position versus target using a red, amber or green (RAG) status. They also show the direction of travel of the latest data against previous results.

Economic Strategy action plan indicators: RAG status summary at quarter 2 2025 to 2026.

Economic Strategy action plan indicators: RAG status by theme at quarter 2 2025 to 2026.

Economic Strategy action plan indicators: performance trends summary at quarter 3 2025 to 2026.

Economic Strategy action plan indicators: performance trend by theme at quarter 2 2025 to 2026.

The information in this document summarises the performance and trend for all 24 metrics in the Economic Strategy action plan.

More detail is given in the appendix.

| Attachment | Size |

|---|---|

| 167 KB |

If the current performance status is ‘red,’ it is over 10% off target or forecast, and the data has changed since the quarter 1 report (2025 to 2026). See the commentary below.

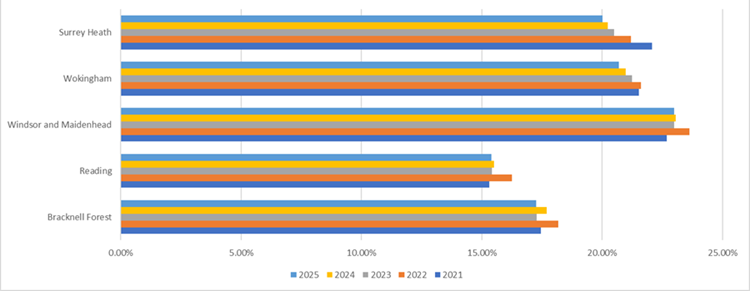

Percentage of knowledge economy businesses

17.26% at September 2025 versus target of 22.99%

There has been a slight decline in the number of knowledge economy businesses, it was previously reported at 17.71% September 2024.

A similar decline can be seen across the FEA.

| Council | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Bracknell Forest | 17.45% | 18.18% | 17.29% | 17.71% | 17.26% |

| Reading | 15.31% | 16.25% | 15.42% | 15.51% | 15.39% |

| Windsor and Maidenhead | 22.68% | 23.63% | 22.99% | 23.06% | 23.00% |

| Wokingham | 21.52% | 21.62% | 21.23% | 20.98% | 20.69% |

| Surrey Heath | 22.07% | 21.19% | 20.50% | 20.22% | 20.02% |

Number of foreign owned companies

26 companies versus target of 35 by 2035.

The target is to achieve a sustained increase in the number of 250 or more foreign owned companies by 2028, with a long term target of 35 by 2035.

Percentage of ICT businesses

12.17% at September 2025 (previously reported 12.36% September 2024) versus target of 18.49%.

(based on latest best in the Functional Economic Area)

The business composition in Bracknell Forest is changing and will be kept under review.

Percentage of working population in lowest 3 occupational groups (RAG status to be confirmed)

There has been a small decrease in the reported number in the lowest 3 occupations from 17.9% (April 2024 to Mar 2025) to 17.5% (July 2024 to June 2025) versus target of 16.5%.

While the percentage of those in the lowest 3 has decreased, there has been only a small change. The target was revised at the end of quarter 1 to reflect the ongoing trend observed locally. It aligns with patterns seen in neighbouring local authorities, where similar increases have been recorded.

The Bracknell Forest Skills Hub continues to support residents to identify and engage with training opportunities to improve employment prospects. This project continues for 2025 to 2026 with support from the UK Shared Prosperity Fund.

There are several performance metrics that remain below target, with some indicators consistently rated red. We are actively addressing these areas, particularly those relating to business competitiveness.

The Berkshire Growth Hub continues to offer a comprehensive triage service to all enquires including start-ups. We are exploring the possibility of additional support targeted at start-ups. We are working with Berkshire Growth Hub to offer targeted retail support for independent retailers in our high street locations in the borough.

The Bracknell Forest Skills Hub continues to play a key role in helping residents upskill, reskill, and improve their employment prospects.

The Bracknell Forest Skills Hub attended the annual Bracknell BID jobs fair held in The Lexicon in September plus the B2B Expo at the Coppid Beech Hotel in July. Both events were extremely successful with high numbers of residents and businesses engaging with the Bracknell Forest Skills Hub team.

Bracknell Forest is delivering positive results across sustainability, housing, and digital infrastructure.

Bracknell Forest is performing well against its climate commitments, reporting a CO2e figure of 3.7. The climate change strategy sets out key actions to achieve net zero emissions as close to 2030 as possible.

Housing affordability remains positive, with a ratio of 9.22 compared to the target of 10.05, supporting affordable living for residents.

Digital connectivity is a key strength, with 96% full fibre coverage and 96% 5G availability. This provides a world-class infrastructure that positions Bracknell Forest as a highly connected location for businesses and communities.

The UK Competitiveness Index is no longer being produced by the Centre for International Competitiveness. They have recently published the NICE Index Report, Economic Possibilities Across England and Wales. This report provides a comprehensive overview of the economic landscape. The NICE Index offers a more comprehensive measure of regional economic potential by assessing 4 key dimensions:

This approach captures the capacity of localities and regions across England and Wales to drive economic transformation, providing a forward-looking framework for evaluating competitiveness and growth opportunities.

The authors have indicated that this report is unlikely to be updated regularly, so we will not use it as an ongoing metric. Nevertheless, it remains an excellent resource, offering a comprehensive snapshot of the current local economic landscape.